The Securities Investment Newspaper has published an analysis of Dr. Quach Manh Hao on outstanding results that Vikoda – a subsidiary of FIT Group has achieved in the strategy of restructuring and repositioning the product. FIT Group republished the above article.

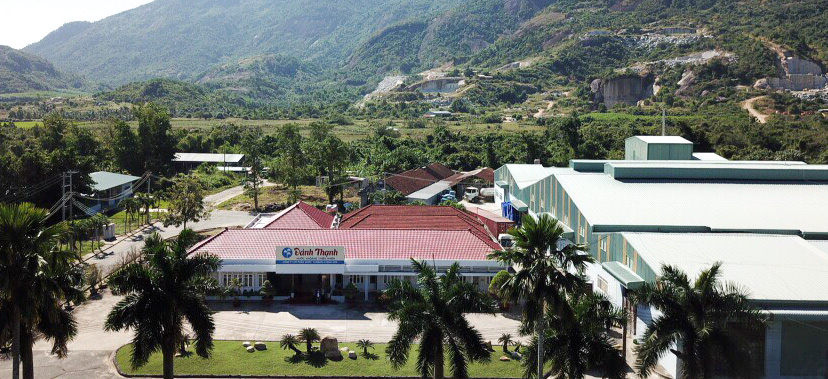

In August 2017, on the occasion of vacation with my family at the resort in Hoi An, I was pleasantly surprised to see bottles of mineral water branded Vikoda and Danh Thanh lined up in the refrigerator for guests. Before that, I used to only see other branded mineral water bottles in hotels and resorts, while the brand Danh Thanh and Vikoda seemed to appear only at popular grocery stores or common supermarkets.

That wonderment is the early result of a strategic transformation. By now, it will not be astounding to see mineral water Danh Thanh and Vikoda at high-end conferences, luxury hotels and resorts, besides showing up at supermarkets and restaurants.

That status transformation is due to the company’s determination to change when positioning the product line with competitive advantage, high class, in line with the trend of using clean, environmentally friendly products for consumers use.

By means of its modern and friendly product design, especially the Vikoda product line that uses glass bottles instead of plastic ones, the company is showing its determination to become a socially responsible business enterprise.

Market success inevitably leads to success in financial results. Revenue in 2019 reached VND 290 billion, 34% higher than the previous year and twice as high as the previous five years.

The revenue growth reflected the product structure and repositioning strategy, the market was on the right track. That, along with solutions to improve management efficiency, especially inventory and sales management, has helped the company achieve a pre-tax profit of 20.3 billion dong in 2019, much higher than the number that is just nearly loss of the previous two years. The restructuring process has been initially successful.

In view of corporate and corporate leaders, though, Vikoda is still far from functional. Over the advantage of high pH water – extraordinarily few in the Vietnamese market as well as highly favorable for Vietnamese users who often consume a lot of acidic substances. In conjunction with investment in mining companies and product lines, the company is optimistic that its sales can reach more than VND 800 billion within the next 5 years. In 2020, the company plans to achieve sales of 352.57 billion, 21.5% higher than in 2019 and pre-tax profit of 28.18 billion, up 39%.

In tandem with ambitious goals lies a specific strategy and plan to accomplish. During the AGM last June, Vikoda’s management recognized the importance of the post-restructuring implementation process.

In this process, it is not a big investment, but the gathering of resources on the main product – mineral water with its research to improve the product packaging design to meet the market demand; enhancing brand promotion; new product development; expand distribution channels into the system of supermarkets, resorts, maintaining the main consumer markets in the Central and Central Highlands then expanding market shares to the West, key channels in Ho Chi Minh City, etc. those are the factors of advancement.

Either the set plans are fulfilled or at least 2019’s post-restructuring growth proceeds in the coming years, it’s not hard to picture the corporate value. According to analysis by the financial strategy division of the group, if revenue in the next 5 years reaches 800 billion with revenue growth of 16.5% to 24.2% depending on the business cycle and then steady growth annually 4%, the enterprise value according to the cash flow method for owners can reach nearly 900 billion VND, or more than 72,000 VND / share according to the current market risk conditions and the proportion of COGS and operating costs are similar to 2019.

Quach Manh Hao