Despite several challenges and difficulties in the last two years, TSC has made decisive moves to change its products and successfully improve the business performance, turning loss into profit.

It seems that businesses in agriculture sector don’t have many difficulties like those in other fields but in reality, these businesses encounter several challenges as they are required to follow strict requirements in term of scale of the business, quality of products and outputs.

Due to the characteristic features of soil in Vietnam, very few enterprises can afford large rice cultivation fields. In addition, a high pesticide and preservatives use on crops is also a factor affecting agricultural products’ quality.

These two elements have a big impact on the production cost (cost of input materials), the consistency of products’ quality and cost of products sold.

The export rice price (USD/ton) in 2019 of Thailand, Vietnam, India and America (from left to right).

The export rice price (USD/ton) in 2019 of Thailand, Vietnam, India and America (from left to right).

Vietnam’s export rice price remains low due to its uneven quality. The profit margin of rice, thus, is very low, despite high revenue.

Vietnam’s export rice price over the years (USD/ton).

Vietnam’s export rice price over the years (USD/ton).

The rice price has undergone big fluctuations over the years, while the profit margin has been low. This puts rice trade and export businesses at risks.

TSC is one of the largest agricultural businesses in the Mekong delta that had big share of rice, cassava and corn products before 2017.

As these products had low profit margin and the company was posed with great price fluctuations, since early 2017, TSC’s board of management decided to shift their direction, cutting down on the areas with poor business performance.

The revenue and gross profit margin of TSC from 2014 to 2019.

The revenue and gross profit margin of TSC from 2014 to 2019.

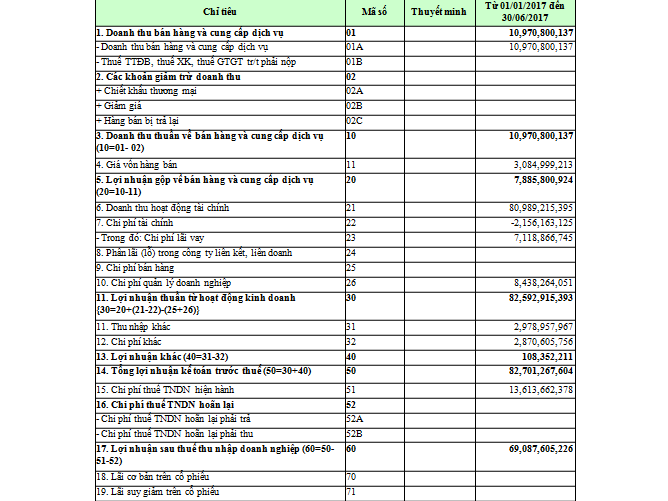

TSC’s revenue decreased dramatically in quarter 1 of 2017 as the company discontinued the production of the products which have low profit margin.

The share of TSC’s revenue in 2016 and 2019. From top to bottom: Agricultural product trade, food processing, seeds, consuming goods and agricultural medicine.

TSC gave up on the products that are not effective, not environmentally friendly and not aligned with the business philosophy of FIT Group. They included agricultural medicine products and agricultural seeds.

Meanwhile, the company boasted the products which have higher profit margin. These products eventually generated the biggest share of revenue for the company.

Profit after tax of TSC (unit: billion vietnamdong).

Profit after tax of TSC (unit: billion vietnamdong).

The financial statement showed that TSC’s profit after tax dropped sharply in quarter 3 of 2016. TSC then carried out a restructuring plan in 2017-2018 period, pushing the fast-moving consumer goods, beverage and agricultural products with high added values. These products have the long-term growth potentials and are those that consumers are willing to pay more for especially in the context of increasing middle class population in Vietnam.

TSC invested its resource into Vikoda with the orientation of in-depth development, improving the quality of products and creating new, unique products rather than just increasing the quantity.

The company also invested in production line and improving the quality of products to meet the requirements of both domestic and international partners including those from Europe and America markets while trying not to depend too much on a single market (especially China market).

With a strategy of creating products that are non-harmful to people and environmentally friendly while cutting down on the products that have no competitive advantage, TSC has made transformational changes in 2019.

Consumer goods’ revenue and profit after tax of TSC (unit: billion vietnamdong).

Consumer goods’ revenue and profit after tax of TSC (unit: billion vietnamdong).

The positive result of restructuring effort is well seen in the change of profit after tax in 2016-2019 period.

The business performance of TSC in the first half of 2019 is a big momentum for the management and staff of the company to put further effort and aim towards surpassing targeted revenue in 2019.