Explaining the low profit but the sharp increase in stock price, Phi Xuan Truong said that the price increase is due to the company’s restructuring of business segments with the main platforms of pharmaceuticals, beverages and chemicals. cosmetics, real estate …

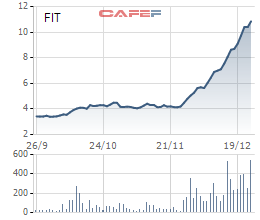

F.I.T shares of F.I.T Group Joint Stock Company escalated approximately 3 times in the last half year. Phi Xuan Truong, Chief Investment Officer, F.I.T Group, said that robust changes in assets, business activities and shareholder structure are the driving forces for this switch.

Sir, the figure of FIT stock has hiked approximately 3 times in the past half year. How do you classify this progress?

As a business leader, I feel very happy about this improvement. Every day, all employees in the whole system are working hard for the purpose of building a stable company, for the benefit of shareholders. Normally, shareholder benefits are expressed in profit, or assets owned by the company, but for listed companies, price factor plays a very substantial role when it comes to shareholders’ welfare.

FIT shares gained unexpectedly in the last 3 months during the first 9 months, FIT’s profit is quite low. Then is this price increase consistent with the business results of the Company, sir?

In my point of view, surplus is one of the vital criteria, yet above all, not to assess the condition of a business.

Presently, we have finished restructuring the business segments with the main platforms consisting pharmaceuticals, food, beverages, cosmetics, real estate; besides financial investment – the traditional segment.

For the pharmaceutical segment, after 2018 due to the overall impact of the industry, from 2019, especially in the fourth quarter of 2019, the company’s earnings have grown actively again, with all fields have been firmly built and will be continuously invested for solid growth ambitions such as: Traditional medicines, empty capsules, cancer drugs, medical supplies and pharmaceutical distribution.

In just a short time, shareholders will see extensive reversals of the pharmaceutical subsidiary, Cuu Long Pharmaceutical Joint Stock Company (DCL). In real estate segment, F.I.T land – the Group’s subsidiary specializing in real estate segment, owns 50% of Ecopark Mui Dinh project, which has high economic potential. We do not appoint massive investment, but determine a steady step for this division, only invest when assessing the effectiveness and feasibility of the project. In the next few years, this project will bring significant revenue to the Group.

Other segments such as food (Westfood), drinking water (Vikoda), and cosmetics all recorded impressive business results this year, presenting the efficiency of the restructuring practice.

Currently, F.I.T Group is holding immense assets which begins to show by business results after the restructuring process. Apart from the process’s results, could you please share your opinion about the reasons for the abnoral increase of stocks, sir?

As far as I concerned, there are 3 considerable reasons for this price escalation, including 2 factors that I mentioned above are changes in business results due to restructuring process, large asset value. The third factor is supply-demand relation.

If you follow FIT from the beginning, you probably remember the sentence that the Chairman of the Board of Directors of the Company once shared, that one of the reasons for the low stock price despite the large asset value, is that shareholder structure is too popular. Presently, Dung Tam Investment Joint Stock Company – the major shareholder of the Company has increased its ownership to over 51% of the Company’s charter capital, which is also a push to help the stock be less lax.

Price not only reflects quality but also stands on the tie between supply and demand in the market. In case the number of better-rated company stocks increases, the number of shares available for free trading decreases, then the price goes up is also understandable. I suppose that it is time for FIT shareholders to pick sweet fruits.

Hai An

Tri Thuc Tre