After the shock of late July due to the Covid-19 outbreak resumption. It is required investors to have a wise investment strategy at this time.

Mr. Nguyen The Minh – Research Director of Yuanta Securities Vietnam recommends that investors can allocate half of their weight to some safe portfolio such as bonds and the other half in stocks.

In order to seek for fine stocks, investors should keep an eye on businesses with growth results in the first – second quarter showing that these are businesses in good condition.

Stocks related to demand for food, medical equipment are still but not as much as before. In the short term, profits will no longer be positive. Mid-term to the end of the year is still secure, but there are not many opportunities as before. Hence, Mr. Minh does not recommend short-term surfing with these stocks.

As for the gold course, Mr. Minh forecasts that by the end of the year, gold price will still be increased, but the profitability rate is not as much as in the previous period.

Mr. Hoang Cong Tuan – Head of Macroeconomic Research Division of MB Securities Company offers two approaches to investors. Firstly, in the long term, investors should take a deeper look at the market situation. The market will recover quickly when anti-epidemic solutions are introduced. Therefore, investors should make long-term investments with idle money and be patient with fluctuations during this time.

In the short term, investors should react according to market movements, disburse at 810 points and take profit at 850 points. Swing profits in this period will not be high and investors must be very patient to avoid psychological traps.

The criteria for stock selection are stocks of declining profit enterprises with business prospects in 2021 or well-resisting this year.

According to Mr. Tuan, Vietnam’s FDI attraction in the first half of the year decreased yet not too much, indicating that Vietnam still attracts foreign capital. Disbursement for public investment has grown strongly, in the last 6 months of the year will be promoted and focused on building infrastructure. Out of there, it will have a positive impact on groups such as infrastructure construction or real estate businesses with projects around the area invested in infrastructure.

However, in order to take advantage of this story, investors must search cautiously to detect businesses with benefit factors, not just investing by industry groups.

Notable stocks …

Despite the fact that the COVID-19 outbreak has a strong and profound effect on the entire economy and in most industries, yet in the pharmaceutical sector, FIT Group Joint Stock Company (HoSE: FIT) still utterly optimistic in the plan to expand factories to manufacture medical supplies, improve the expansion of capsule 4 factory and initially develop a project to build a GMP – EU pharmaceutical factory. Expected revenue in this field in 2020 bring about to the Group 844 billion VND, profit after tax is 83.6 billion VND.

FIT Group is a multidisciplinary conglomerate that owns companies with high growth potential

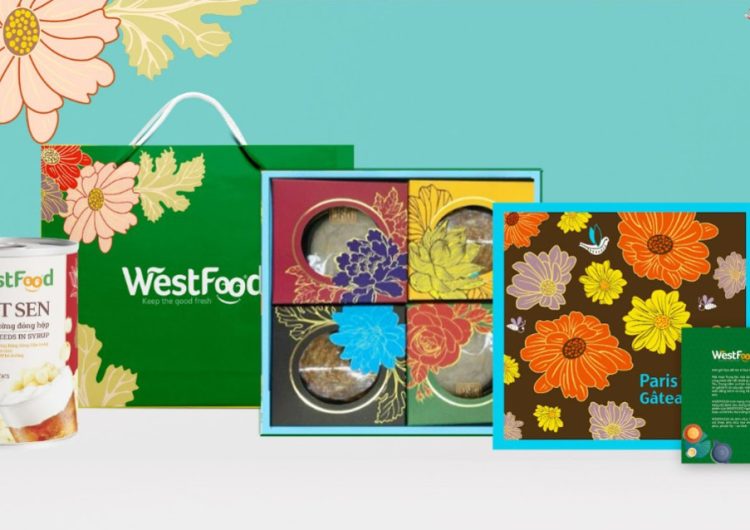

In sectors suchlike Agriculture – Food, FIT will enlarge investment in raw material areas to increase initiative and advance business profit margin. With FMCG products, R&D will be focused on developing superior products, leading the Group’s subsidiaries to the ranks of the most powerful enterprises in the FMCG industry.

Along with that solid foundation, in 2020, FIT targets net revenue from operating activities to be 1,383.5 billion, up 16% compared to 2019, total pre-tax profit is 171.3 billion, up 43 % compared to 2019.

In Q2 / 2020, FIT’s net revenue in the period reached VND 241 billion, gross profit reached VND 62.4 billion. Deducting all costs, the Group’s after-tax profit was 38.6 billion dong, 3.4 times higher than the second quarter of 2019; Parent company pre-tax profit reached 47,253 billion.

In the first 6 months of 2020, FIT reached nearly 540 billion dong of net revenue; profit before tax reached over 51.3 billion.

FIT’s Board of Directors affirms that operating in accordance with the set core values, which is to build the business into an effective investment group, increase value for shareholders, through a diversified investment advisory product chain, quality and professional portfolio.