Arising from an investment company, up to this point, the parent company F.I.T is still doing the sole function: investing. However, the difference in quality in investment methods, investment portfolios… has created a completely different look of F.I.T Group Joint Stock Company (F.I.T Group).

Having a conversation with reporters, Ms. Nguyen Thi Minh Nguyet, General Director of F.I.T Group – stated that choosing the big investment path, accompanying and building the value of the investment business despite difficulties and hardships take plenty of time and effort, yet the results obtained so far are attractive enough for the Company to persist with that path.

Over the years, F.I.T Group has transformed itself from an investment company to a holding company, with businesses operating in basic and essential industries. How do you rate this transition?

The current operating model of FIT Group is holding, in which the parent company plays the role of capital management, controlling ownership of member companies operating in basic and essential industries such as pharmaceuticals and supplies. Medical; food – beverage; cosmetics, real estate…

This is a higher development step of investment activity – the original industry of FIT Group, as we do not hope our investment activities to be awaiting the others’ growth, but rather investing enough to the core industries and companies which own special business advantages then invests in human resources, strategy, management, finance, marketing, etc. to promote business development, thereby sustainably increase the value of your investment.In the matter of conventional financial investment, this approach requires more thorough research, a comprehensive methodical investment for the target business, as well as a long-term follow-up. This also leads to many challenges for the Board of Directors, especially when F.I.T Group is already a listed company, under pressure from public shareholders on revenue and profit growth. Because as you can see, the dominant investment in the business needs enough time to bring the ideas and investments into effect. The qualitative change of the business sometimes takes years to achieve the goal, it probably only later to the quantitative growth that is the profit figure on the financial statements.

So far, in your opinion, has F.I.T Group achieved its goal?

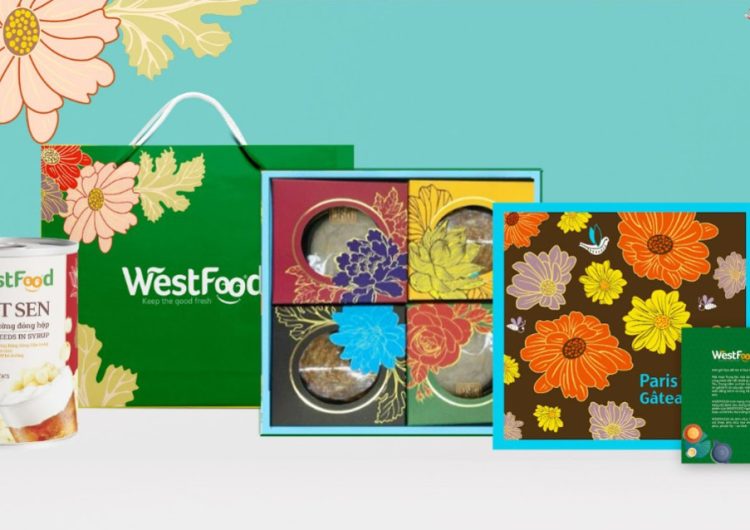

The point is which goal is being mentioned. In terms of revenue and profit goals perspective, we will only enter a breakthrough phase this year. From the perspective of qualitative change, now, F.I.T Group has basically achieved its goal. In the past few years, FIT has completed the goal of building high-quality businesses in industries such as: Pharmacy, pharmaceutical supplies, medical supplies in the group of companies under Cuu Pharmaceutical Joint Stock Company. Long (DCL), agriculture, food at Can Tho Agriculture, Westfood, drinks at Vikoda, real estate at FIT Land…

Cuu Long Pharmaceutical has invested nearly 20 million USD to build a Benovas Medical Equipment factory to meet European standards in March 2021.

Currently, we have basically built up the elements of strategy, management, human resources, products, marketing, finance… for member companies, inclined to create growth runways in each field. From a quality perspective, we have well accomplished the set goal. Recently, the Board of Directors of the Group also hired an independent unit, VACO Auditing Co., Ltd. To revalue the net asset value of the group of companies, we were valued at nearly 10,000 VND billion dong net worth, calculated on the financial foundation at the end of 2020, on the current charter capital of more than 2,500 billion dong, equivalent to the price of nearly 40,000 dong/share of FIT. This value does not include intangible assets that the group of companies own such as alkaline water mines, and land assets that do not reflect the market value sufficiently.

This is the motivation for the Group’s Board of Directors to try harder in building the company’s value, but also the pressure for us, because of the challenge of realizing the investments and maintaining the growth target.

Mui Dinh Paradan Experience Tourist Area Project – the factor that helps FIT Group solve the billion-dollar problem

In your prospect, when is the time for the shareholders to reap the investment benefits and transform this investment business?

As I said above, it takes time for the qualitative change of businesses to turn into revenue and profit figures.However, with the current business situation of enterprises, right in 2021, shareholders will witness the take-off of businesses. Up to now, businesses are closing the end of the semi-annual report period, but the preliminary report on operating activities shows that all industries have grown very well, despite the Covid-19 progressive situation in many places.Regarding the revenue and profit figures, I would like to publish them later to ensure that they are official and have no errors, however I believe shareholders will be pleased that the process of accompanying FIT has gradually brought about some well worth results alongside the effort we put in.