(DTC) After 8 years of becoming a public company, F.I.T Group Joint Stock Company (FIT Group) – stock code FIT has made great strides with its aims to become a billion-dollar corporation in the future. Therefore, VACO Auditing Co., Ltd. is valuing FIT shares at 40,000 VND/share, nearly 4 times higher than the first day of listing.

FIT shares listed on HNX on July 26th, 2013.

On July 26, 2013, 15 million FIT shares were officially listed on the Hanoi Stock Exchange (HNX) with a reference price of 11,000 VND/share.

After listing, FIT Group has made a dramatic change in both scale, operating model and business efficiency.

Since the beginning of 2014, FIT Group has embarked on accelerating the transformation of operations, with strong growth in equity, changing the asset structure towards spending 80% of total capital for long-term investment in subsidiaries, affiliates in the field of basic products on the side of: agriculture, food processing, pharmaceuticals, consumer goods including drinking water and cosmetics.

The invested enterprises all meet the requirements of the industry, possess a large market size, high growth potential and clear development orientation, strong business foundation. Therefore, FIT stock entered the HNX30 basket after only 14 months of listing.

|

| On August 19th, 2015, the official FIT stockListed on HSX |

In August 2015, to mark a comprehensive transformation from an investment company model to a holding model as well as to increase access to foreign investors, FIT Group moved its listing from HNX to the Ho Chi Minh City (HSX) with the number of 179.2 million shares, which is an increase of nearly 12 times after only 2 years of listing on HNX. Up to now, the total number of FIT shares listed on the HSX is 254,730,247 units.

Currently, FIT Group has become an investment group that owns companies with high growth potential in developed industries including: Pharmaceuticals; Consumer goods industry suchlike drinking water and cosmetics; Agriculture and Food; Resort Real Estate.In 2021, FIT Group will kick off the first phase of the Padaran Mui Dinh Experience Tourist Area project, which is Bai Trang, including beach villas and mountain villas overlooking the sea; 5-star hotel with 500 rooms with a total investment of 100 million USD. These products will include the purpose of selling, leasing and operating.Particularly for phase 1, although the total investment is not large, it is expected to bring a profit of 2,500 billion VND. The total project of Mui Dinh Padaran has a total investment of 1.2 billion USD, on a scale of nearly 800 hectares in Ninh Thuan.

|

| Mui Dinh Padaran project to solve billion dollar problem of FIT Group in the future. |

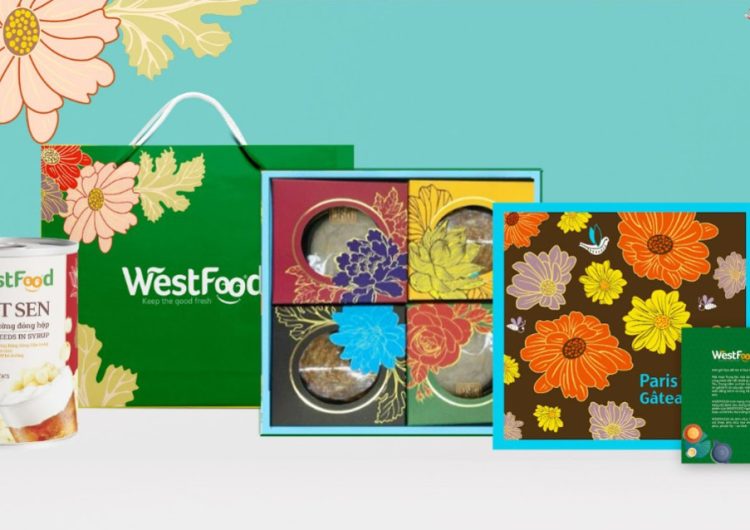

In addition, in 2021, the pharmaceutical field (Cuu Long Pharmaceutical – DCL) completed and put into operation the Capsule 4 factory with an output of 2.4 billion capsules/year, bringing the total volume of capsules produced to nearly 8 billion tablets/year; invest in Benovas Medical Equipment Manufacturing Factory meeting European standards in March 2020 with a value of over USD 15 million; cooperated with MA Holder to distribute cancer drugs, this forecast DCL’s revenue will reach 804 billion dong, gross profit will be 301.5 billion dong.Besides, the enterprise continues to promote and perfect the sales model to increase the coverage of Cuu Long Pharmaceutical products to all localities in the country and to export a number of products.Regarding agricultural products and processing agricultural products for export, Westfood expands cooperation with agricultural partners to build a new factory, expanding the raw material area expected to reach 1,000ha in the next year.

For the Vikoda brand, in 2021 with the motto “Fast to Win”, this business will take breakthrough actions to achieve the set goals acting as: revenue reaching over 410 billion VND, gross profit reaching over 177 billion, an increase of nearly 50% compared to 2020.In July 2021, VACO Auditing Co., Ltd. revalued the net asset value of the group of companies, as also FIT Group reaches nearly 10 trillion dong on the current charter capital of more than 2,500 billion dong, equivalent to nearly 40,000 VND/share of FIT.This value does not include intangible assets that the group of companies own such as alkaline water mines, as well as land assets do not reflect the market value sufficiently.