Financial income 3 times higher than the same period last year, along with saving many types of expenses contributed to FIT big profits reported in Q4 / 2019.

F.I.T Group Joint Stock Company (stock code: FIT) has announced the Consolidated Financial Statements for Quarter 4, 2019 and accumulated for 2019.

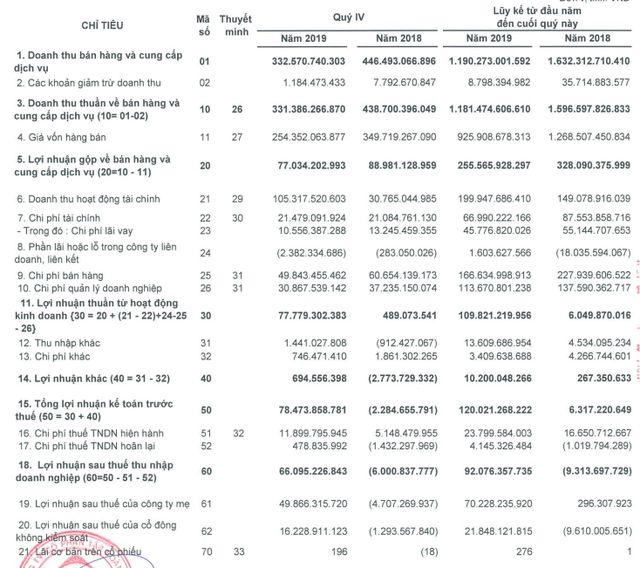

Accordingly, in the fourth quarter solely, net revenue reached VND 331 billion, downgrade 25% over the same period, after deducting gross profit of more than VND 77 billion, decline 13.5% compared to Q4 / 2018.

During the period, FIT earned VND 105 billion in revenue from financial activities more than 3 times higher than the same period while financial expenses only increased slightly, selling expenses and administrative expenses decreased by 18% and 16 respectively compared to the same period of 2018, resulting in a net profit of 66 billion dong of FIT, of which the same period saw a net loss of 6 billion dong, in which, the EAT of parent company was 50 billion dong.

Mr. Phi Xuan Truong, Investment Director, FIT Group, in his recent sharing, stated that, at present, FIT has completed restructuring its business segments with main platforms including pharmaceuticals, foodstuffs, beverages, cosmetics, real estate; besides the traditional segment of financial investment. For the pharmaceutical segment, 2018 afterwards, due to the overall impact of the industry, in 2019, particularly in the fourth quarter, the Company’s yield have grown firmly again, in conjunction with all businesses have been robustly built. and being on the way to be invested for solid growth goals such as: Traditional medicines, empty capsules, cancer drugs, medical supplies and pharmaceutical distribution. In just a short time, shareholders will see extensive development of the pharmaceutical subsidiary, Cuu Long Pharmaceutical Joint Stock Company (DCL). Along with real estate segment, F.I.T land, the Group’s subsidiary specializing in real estate segment, holds 50% of Ecopark Mui Dinh project, has high economic potential. We do not choose massive grant, yet determine a steady step for this segment, invest only when estimating the effectiveness and feasibility of the project. In the next few years, this project will bring significant revenue to the Group.

Other segments such as food (Westfood), drinking water (Vikoda), and cosmetics all recorded impressive business results this year, showing the effectiveness of the restructuring process.

By 2020, the company will focus on starting up large potential projects such as the construction of the most modern medical supplies factory in Vietnam, building capsule 4 factory, and Mui Dinh project. In the second phase, while Westfood continues to penetrate deeply into potential international markets, Vikoda will promote business activities through the launch of new high-end product lines.

Since the beginning of 2019, FIT’s share price has increased by 294.53%, with the average daily trading volume in the past month reaching about 2.7 million shares per session. FIT shares reached a peak of 10,850 VND per share in the trading session on January 25, then corrected sharply and now stood at 8,580 VND per share.