The financial status of F.I.T Group Joint Stock Company (HoSE: FIT) is in great shape as money and short-term financial investment assets constantly remain ultra high.

Against the backdrop of the Covid-19 epidemic unfolding tangledly, many businesses had to reduce their production scale and confront the risk of bankruptcy, FIT yet owns an extremely desirable financial structure. This is the result of the process of accumulating and controlling spending for many consecutive years. Even in difficult times, FIT can continue to expand production investment or prop up for potential projects.

FIT’s EAT in the first half of 2020 nearly quadrupled the same period, reaching more than 40 billion in the first 6 months. This result is the result of the previous restructuring process, which helped gross profit grow year on year despite a slight decrease in revenue. The epidemic is also an opportunity for the corporation to reorganize its sales system in its member companies, thereby significantly reducing selling costs.

Activities of the parent company: Acknowledged the sophisticated happenings of the persisting epidemic, the parent company has drastically directed the member companies to have appropriate coping scenarios, modify the sales process at member companies to suit the development of the economy. In addition, the leaders of the group together with leaders at the member companies reviewed and cut costs in accordance with the revenue results.

Beyond that, catching the demand and the rapid turnover of capital flows, FIT has promoted financial activities and products, helping revenue and profit from this activity s-sturdily grown in the second quarter / 2020. In the quarter, the financial expense recorded 4 billion dong because FIT implemented the provision reversal of nearly 9 billion.

FIT Group is a multidisciplinary conglomerate that owns companies with high growth potential in

Pharmaceutical segment: In the second quarter of 2020, sales of the pharmaceutical segment slowed down in almost all segments, of which ETC was the sector most affected.

Compared to the first quarter, revenue of the OTC segment did not grow as strongly as in the first quarter, accumulated revenue from the OTC segment achieved the set plan and grew slightly compared to 2019. ETC segment had less positive developments when the epidemic had affected some drug procurement plans.

Capsule section is still active despite many fluctuations in orders from partners. Revenue did not meet expectations but was 3% higher than the same period last year.

The medical supplies sector continued to escalate, due to the constant implementation of cost savings and the promotion of selling products with high profit margins, the gross profit of the medical supplies segment improved significantly. This is also a field with a lot of growth potential and the company is planning to expand and build a new factory.

Agriculture section: This is an area clearly affected by the slowdown in logistics that makes many agricultural products experience difficulties in the export process. Besides, the price of agricultural products at times drops very low, making businesses actively not import products to produce, but with consistent policies throughout the group on reducing cost of capital, gross profit and net profit from production and business activities almost the same as the same period in 2019:

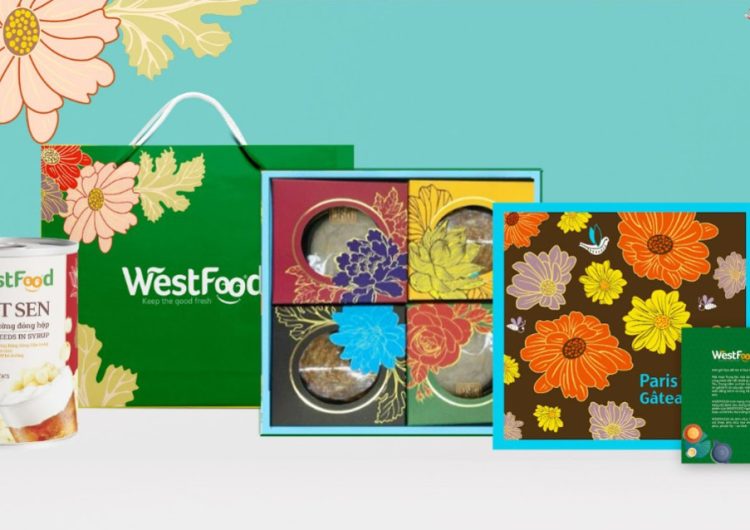

Westfood: In the second quarter of 2020, the profit remained stable at a high level, for the first 6 months of the year, the revenue achieved 45% of the year plan and grew over the same period. During the quarter, Westfood also actively increased purchasing and chose the right time to buy ingredients, mainly fruit, for processing. This helps Westfood’s COGS are controlled very well and profit reached 49% of the year plan.

Thus, Westfood is a segment with a fairly clear growth in profit despite the fact that the agricultural product processing sector suffers from many negative impacts from the Covid-19 epidemic. In the second quarter, Westfood started to receive new product orders and new cup making lines began to operate.

Vikoda: The second quarter of 2020 is the quarter of Vikoda, with a clear improvement in business results compared to the first quarter of this year. The revenue growth is partly due to the fact that in the second quarter, Vietnam has been quite successful in fighting the epidemic, helping the number of tourists in key areas of Vikoda to recover.

Although revenue declined, but with austerity, especially with the cost reduction, marketing programs are no longer suitable which make the profitability of businesses became very positive in the second quarter, enlarging rapidly compared to the first quarter of this year.

HPC: The FMCG segment with body care and home hygiene products saw positive changes in the first quarter and continued to the second quarter of this year. For the first 6 months of the year, Personal Care products grew more than 50%, but home care products decreased slightly by 10% over the same period. Among Personal Care products, the hand sanitizer product maintains high sales and popular with consumers.

In 2020, FIT sets a rather ambitious growth target with net revenue from operating activities of 1,383.5 billion VND, an increase of 16% compared to 2019, total pre-tax profit of 171.3 billion VND, an increase of 43 % compared to 2019, total consolidated after-tax profit reached 136.2 billion, the ratio of profit after tax / net sales is expected to reach 9.8%.