FIT Group and its member companies are heading for one of the most important times in their corporate restructuring process: annual shareholders meeting season – when strategic deisions are made.

In the year 2017, the move to new business model, targeting for sustainable value for shareholders, has accompanied important investment decisions made by the group and its member companies. Specifically, the Cuu Long Pharmarcy (DCL on HSX) has acquired Euvipharm, built a new Capsule III factory, and especially joint the venture Benovas with SCIC. Meanwhile, Can Tho Techno – Agricultural Supplying (TSC on HSX) has cut down business lines that are not suitable to the group’x expertise such as TSP and other trading activities. Khanh Hoa Mineral Water – FIT Beverage (VKD on HNX), which owns a special mineral water source with pH >=8.5, has invested in production lines, product identification and especially the distribution network. And last, perhaps the most important, is that the group has chosen to make itself more transparent, efficient and honest to its stakehoholders.

Corporate restructuring is never an easy process, which cannot avoid losses. FIT and the member companies are not out of that law. The obvious consequence is a decline in sales in most business lines, resulting from making capital investments and redirecting the business model. The data from 2017 financial statements shows a decline of 33% comparing to 2016. The decline in sales have led to a decrease of 21% in most profit figures, although not at the same pace. Notably, TSC has made a loss of VND 30bn while VKD did not make a profit.

But is was a worth-while trade-off, as most operating efficiency indicators have all improved. Before- and after-tax profits to sales and gross profits have been better than before on average in all business lines. A specific example is the before- and after-tax profit to net sales have increased from 8.1% to 10.1% and from 5.9% to 6.9% respectively in 2017 compared to 2016. It should be well noted that the operating cash flow of the group has increase significantly from a negative 90bn in 2016 to 97bn in 2017. Although the achievement is just initial, it has proved the soundness of the strategic choice: sustainable shareholders’ wealth has been chosen instead of short-term showy performance.

In summary, the corporate restructuring and business model renovation have been on the right track. The year 2018 is promising to see our endless efforts, which have been made at the cost of short-term benefits, being converted into corporate performance. We, the leaders, managers and every member of staff, have been waiting for the new future of the group. Looking at the business plans that have resulted from professional and continuous dialogues and discussions between our people about our capacity and market potential, we are confident that better results are awaiting us. It is never late to do right things.

SM calendar and business plan for 2018:

- VKD: On April 20th in Hanoi, focusing on continuing the investment process to improve the production process, improve product quality, focus on key products, build distribution channels and start being profitable in 2018.

- DCL: On April 21st in Hanoi, focusing on realizing the plan to increase revenue from investment in Euvipharm and to build Capsule III factory; develop new product lines; at once, establishing Benovas joint venture and studying to build the new Capsule IV plant, as well as the high-tech medical equipment factory; expected sales growth of 26% and profit of 15%.

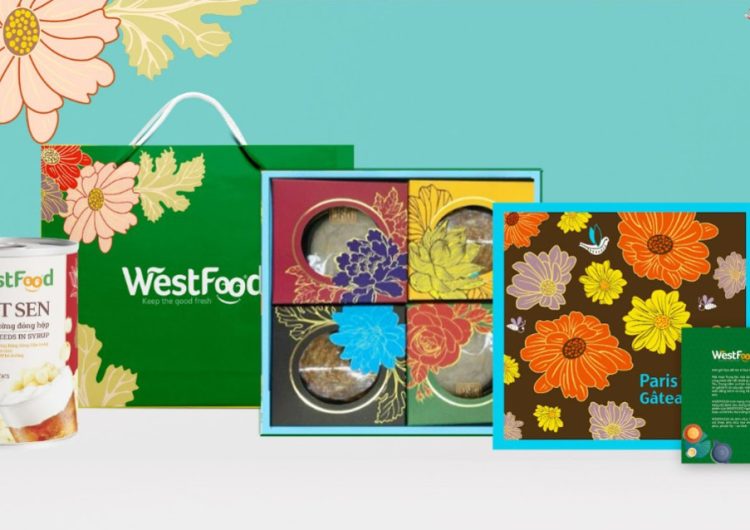

- TSC: April 24th in Hanoi, focusing on the development of materials for foodstuffs (Westfood) and consumer goods; expecting a 25% revenue growth and profit growth from minus 30 billion VND in 2017 to break even in 2018.

- FIT: April 27th in Hanoi, focusing on developing and improving the transparent, effective and honest corporate – member companies governance model; promoting the strength of investment and financial consulting services financial services; estimating revenue growth at 25% and profit margin at 13%.

Unit: billion VND

| FIT | DCL | VKD | TSC | |||||

| 2017 | Plan 2018 | 2017 | Plan 2018 | 2017 | Plan 2018 | 2017 | Plan 2018 | |

| Net revenue from business activity | 1625 | 2037 | 765 | 963 | 211 | 245 | 825 | 1028 |

| After-tax profit | 112 | 127 | 75 | 86 | -0.01 | 0.1 | -30 | 0 |

| Revenue growth | 25% | 26% | 16% | 25% | ||||

| Profit growth | 13% | 15% | – | – | ||||