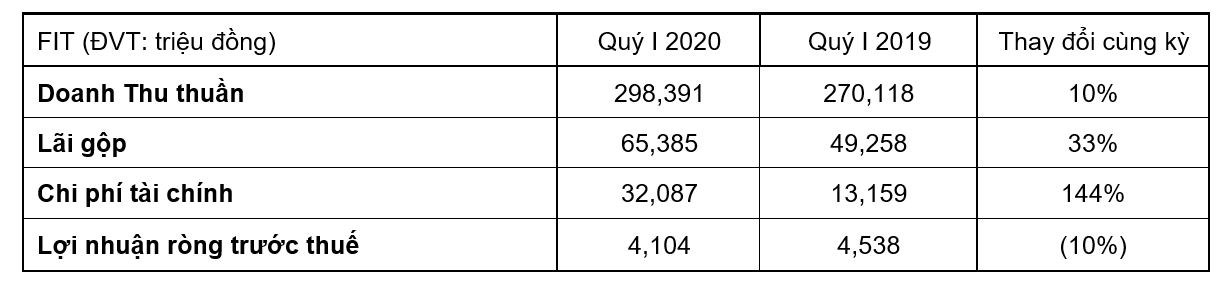

The first quarter of 2020 is a quarter marked a clear alteration in business performance and extremely positive switches. However, if we only glance at the after-tax profit figure, we can not see all these positive transforms. Although the Covid – 19 epidemic shaken up the world leads to a series of production and business activities stalled, due to the activities in the field of manufacturing and trading of essential commodities, the turnover of the whole Group still grew 10% in the pandemic context. Not only boosting sales, F.I.T and its affiliates maintain control of production costs through which gross profit can grow by up to 33%.

Most investors still have the practice of just glancing at the consolidated profit before tax and after tax figures without a comprehensive view and have not seen a much brighter picture at F.I.T Group.

Although the profit before tax of F.I.T Group in the first quarter of 2020 did not grow over the same period, it was affected by non-production factors. The reason came from the fact that F.I.T Group recorded financial expenses of up to 32 billion dong in the first quarter of 2020 compared to about 13 billion dong of the previous year. In particular, the surge in financial expenses stemmed from the recognition of provision for devaluation of trading securities up to 11.1 billion dong. Nevertheless, alongside with the financial market recovering strongly in April as also F.I.T Group settling these investments, F.I.T Group will immediately revert 9.9 billion dong. In April and the first days of May, all FIT Group’s production and business activities are still going smoothly, hence we can keep up setting higher targets for business results in the quarter II of 2020.