F.I.T Group Joint Stock Company (Stock Code: FIT) has recently issued a resolution to relieve a senior executive.

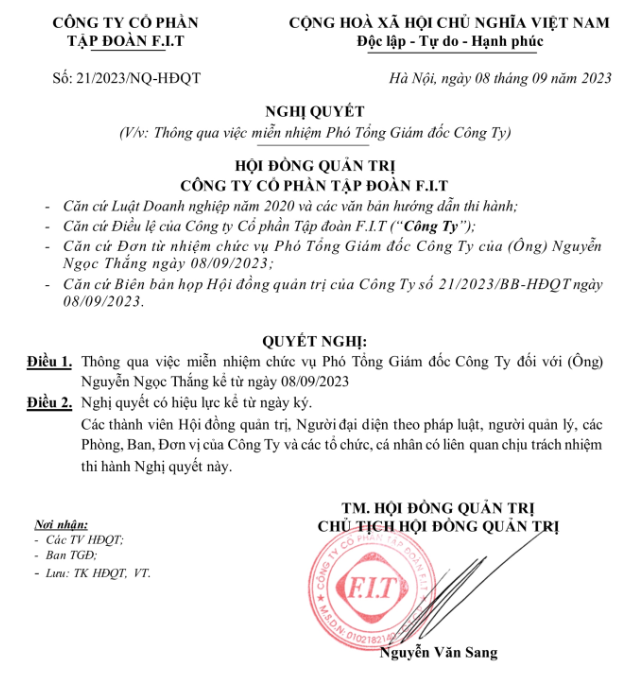

Accordingly, the Board of Directors (BOD) of F.I.T Group issued Resolution No. 21/2023/NQ-HDQT regarding the dismissal of Mr. Nguyen Ngoc Thang from the position of Deputy CEO in charge of Strategy, effective from 08/09/2023.

Mr. Nguyen Ngoc Thang was appointed as the Deputy CEO in charge of Strategy of F.I.T Group from 03/10/2022. Before that, Mr. Thang held middle and senior management positions in multinational corporations such as Procter & Gamble Vietnam and Coca Cola Vietnam. During his nearly one year of working at F.I.T Group, Mr. Thang contributed to strategic planning, brand identification for the Group and its subsidiaries.

According to his resignation letter, due to personal reasons, Mr. Thang couldn’t allocate time to fully participate in the company’s activities in the role of Deputy CEO. Based on the resignation letter, the BOD of F.I.T Group issued Resolution No. 21/2023/NQ-HDQT, approving the dismissal of Mr. Nguyen Ngoc Thang from the Deputy CEO position. Thus, from 08/09/2023, Mr. Thang will no longer hold a leadership role at F.I.T Group.

The full text of Resolution No. 21/2023/NQ-HDQT was issued on 08/09/2023 regarding the dismissal of the Deputy CEO.

This personnel change does not affect the operation of F.I.T Group. According to the Consolidated Financial Report – Semi-annual reviewed 2023, F.I.T Group’s total assets in the first 6 months increased from 6,997 billion VND to over 7,280 billion VND; owner’s equity increased from 5,864 billion VND to over 5,897 billion VND. By the end of Q2/2023, F.I.T Group possessed over 7,280 billion VND in total capital.

The business situation of member companies also showed positive signs:

In the field of Pharmaceuticals/Medical Equipment, Cuu Long Pharmaceutical recorded revenues of over 512 billion VND, an increase of 18% compared to the same period; total assets increased from 2,105 billion VND to 2,139 billion VND; owner’s equity increased from over 1,391 billion VND to over 1,421 billion VND.

In the field of beverage business, in the first 6 months of 2023, Khanh Hoa Mineral Water Joint Stock Company (VKD) reported a post-tax profit growth of 398% compared to the same period last year. The company has continuously expanded and increased brand recognition of its products, especially the natural alkaline mineral water brand Vikoda.

In the FMCG field, FIT Cosmetics successfully launched the Tero bio-product line, including bio-laundry detergent, bio-dishwashing liquid, and bio-floor cleaner, providing consumers with friendly, safe, and environmentally friendly cleaning products. The Tero bio-product line uses 100% European multi-enzyme technology, leading the bio-technology trend in Vietnam.

In the field of Agriculture, by the end of Q2/2023, TSC recorded revenue of over 126 billion VND, an increase of 27% compared to Q1/2023; pre-tax profit also reported a gain of over 33 billion VND compared to the previous quarter.