In the second quarter, TSC received more than 84 billion dong of profit from the merger with Khanh Hoa Mineral Water (Vikoda) after this business officially became a subsidiary from the end of June.

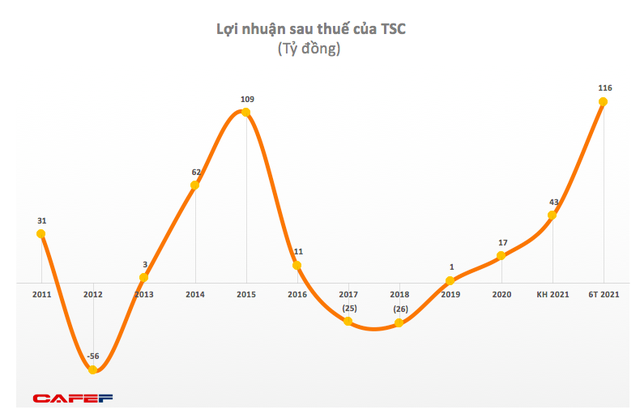

Can Tho Agricultural Technical Materials Joint Stock Company (stock code: TSC) has announced its financial statements for the second quarter of 2021 and the first 6 months of 2021 with high revenue and profit over the same period.

Specifically, in the second quarter alone, net revenue reached 108.5 billion dong, gross profit reached more than 22 billion dong, slightly increased over the same period. Notably, financial activities brought TSC nearly 222 billion VND, a sharp increase compared to 1.3 billion VND in the same period.

Although financial costs also increased, joint venture activities suffered a loss of nearly 5 billion dong, yet thanks to large financial revenue, TSC’s profit after tax was 123 billion dong, 20.5 times higher than in the second quarter of 2020. Parent company’s NPAT is nearly 115 billion dong, equivalent to EPS of 778 dong.

Accumulated in the first 6 months of 2021, TSC reached 254 billion dong of net revenue, NPAT was nearly 124 billion dong, 14 times higher than the first half of last year. EAT of parent company is 115.6 billion dong, equivalent to EPS of 783 dong.

In 2021, TSC sets a revenue target of 519.7 billion dong, pre-tax profit of 46.4 billion dong, double that of 2020.

Thus, along with this plan, by the end of the second quarter of 2021, TSC has completed 48.8% of the revenue target and 275% of the profit plan.

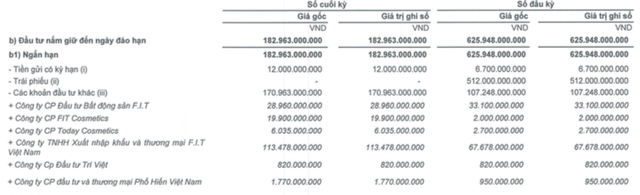

As of June 30, 2021, TSC’s total assets reached more than VND 2,245 billion, up 12.7% compared to the beginning of the year with the main contribution being short-term financial investments, which decreased sharply from VND 626 billion to VND 626 billion. the remaining VND 183 billion due to the investment in buying convertible bonds of VND 512 billion of Lotus Vietnam Investment and Trading Joint Stock Company, the company has completed the bond settlement in the form of interest with the interest rate of 5%/year. Besides, TSC’s commercial advantage increased from 5.8 billion dong to 626 billion dong.

The short-term effects of this restructuring process can be seen when TSC’s revenue and profit decline in the next 3 years from 2017 to 2019.

Instead of expanding in breadth, TSC focuses its resources on industries with competitive advantages and long-term potential. Specifically, TSC has properly positioned its products to have appropriate strategies, promote R&D to create more added values.

Typical for the success of the structural process is the premium natural mineral water product (Vikoda). This is the product that embodies the philosophy of bringing high value, purity to human health and being friendly to the environment.