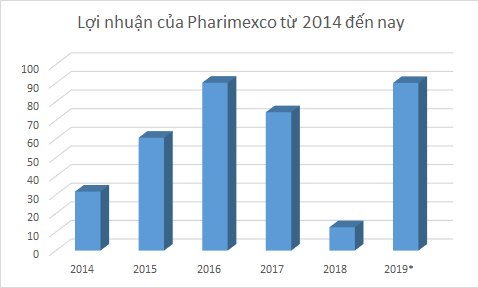

Pharimexco’s yield are likely on the way to return to a strong growth cycle since 2018 in accordance with this measurement.

As reported by Cuu Long Pharmaceutical Joint Stock Company (Pharimexco-DCL), the company expects to reach nearly 90 billion dong of profit in 2019. This figure increased sharply compared to 2018’s, approaching the previous profit peak achieved in 2016.

This outcome is completely opposite to the surplus that they achieved in the first 9 months. DCL recorded loss in business results in the first and second quarters of this year. Company’s revenue increased again in the third quarter of 2019, yet the accumulated 9 months of the year was just less than 2 billion dong of after-tax profit from parent company. The large number came mainly from the fourth quarter of 2019’s profits, including a significant part from the Company’s restructuring activities.

The historical profit chart of recent years illutrates that DCL has made a very strong move since becoming a member company of F.I.T Group (2015). Accordingly, in the first year F.I.T became the parent company (in 2015), DCL’s profits doubled compared to 30 billion VND in the previous year, and continued to grow in the following years. Due to the overall impact of the industry on raw material prices since the end of 2017, DCL’s profitability has been reduced, but thanks to restructuring efforts, 2018 has been a bottom year for benefit.

DCL made a breakthrough again in business in 2019, along with the restructuring of the company in the DCL system, the company earned more than 190 billion VND from divestments. In line with a source from DCL, the company currently has abundant financial resources and planning to expand operations in all areas such as pharmaceuticals, empty capsules, drug distribution, cancer drugs, and medical supplies and products to accomplish more impressive growth figures from this time forth.